How Much Car Can I Afford?

A Guide for First-Time Buyers

| By: Veronica Balderas, Financial Coach | |

| February 1, 2026 | clock icon 7-minute read |

Buying your first car can be exciting! But figuring out what you can actually afford—that can be tricky. Most people focus on the monthly payment, but there's way more to consider. You’ll need to think about insurance, gas, maintenance, and all those other costs that pop up once you own a car.

Getting the right vehicle at the right price from the start can save you a ton of stress later. The last thing you want is to buy a car you love, then realize three months later that you can't afford to keep it. Let's break down exactly how to figure out what works for your budget.

How Much Car Can I Afford?

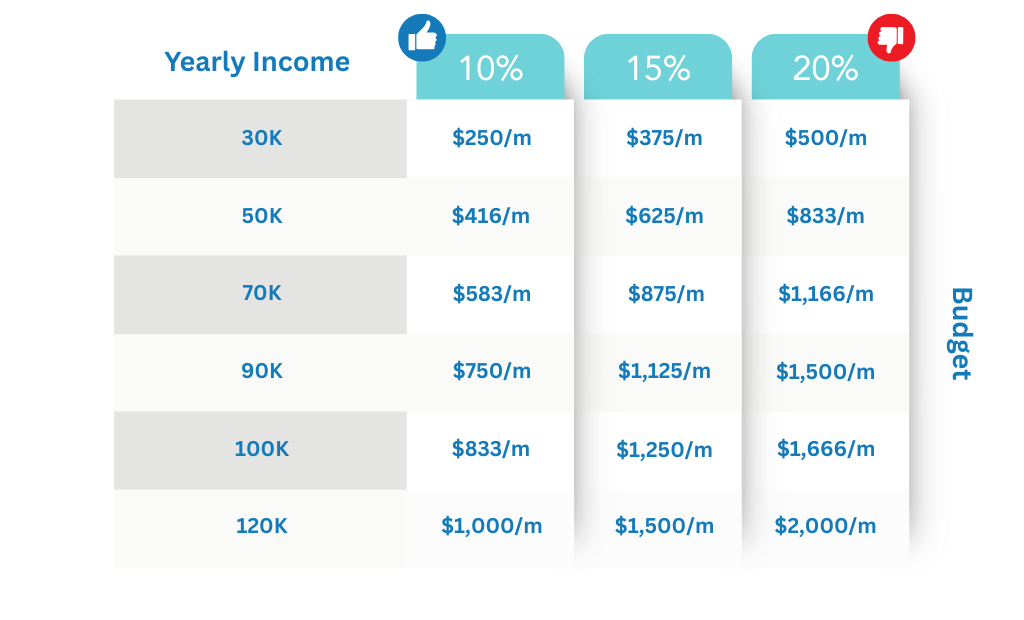

Everyone's financial situation is different. If you need a starting point, follow this simple guideline from experts at NerdWallet. Your total car expenses should be less than 15% to 20% of your monthly income (after taxes, health insurance, 401K, etc. are deducted from your paycheck). These expenses include your monthly car payment, insurance, gas, and maintenance and repairs, all added together.

Let's say you make $3,100 a month after taxes. That means your total car costs should be less than $620 per month. Sounds simple enough, right? It is if you know how to calculate your car’s total expenses and not just the monthly payment.

Do yourself a favor and figure out your complete budget before you start looking at your first dream car. Auto dealers may try to get you to focus on just the monthly payment, but that's only part of the story. When you know your real budget ahead of time, you won't fall for a car you can't actually afford.

The Total Cost of Buying a Car

Insurance: Your Choice of Car Matters

The price of car insurance depends on many factors. These include your age, driving record, where you live, and if you buy a new or used car. Younger drivers usually pay more. New cars usually cost more to insure because they're worth more money.

Before you pick a car, call a few insurance companies to get quotes. Tell them the exact car you're thinking about buying. Keep in mind that most vehicle loans require you to insure the vehicle for enough to pay off the loan if the car is “totaled” in an accident.

Here's a good rule to follow: Your insurance and gas combined should stay at 7% or less of your monthly paycheck (after taxes). So, if you bring home $3,100 a month, that's $217 total for both. If insurance quotes are higher than you expected, you might need to consider different vehicles.

Gas: It Adds Up Fast

Gas prices go up and down, but you can still predict roughly what you'll spend. Think about how much you'll actually drive.

Driving to work or school every day? Taking road trips on weekends? Be realistic about it because most people guess too low.

Once you know your driving habits, compare them to the car's gas mileage. A car that gets 20 miles per gallon (MPG) will cost you a lot more than one that gets 35 MPG if you're driving a lot. You can find fuel cost calculators online that do the math for you, or you can figure it out yourself pretty easily.

Want to save money? Look for cars that are good on gas. You don't need a hybrid or electric car to save money (though those may help). Plenty of regular cars get great mileage, so pick one that best fits your needs.

Maintenance: New vs. Used

New cars come with warranties that cover most repairs for the first few years, so your maintenance costs usually stay pretty low and predictable during that time. That means you'll likely just pay for oil changes and basic stuff. Be sure to research what is included in the warranty to better weigh your options.

Used cars are the opposite. You'll pay less upfront, which means smaller monthly payments. But as cars get older, they need more work. A car with over 50,000 miles might need new brake pads or tires soon. A car with over 180,000 miles could need more expensive repairs, like suspension work.

Maintenance widely varies depending on the car. Look at the maintenance manual for the car you are considering to get an idea of what you’ll need to repair or replace as time passes.

AAA recommends setting aside about $50–$100 every month for maintenance and repairs. Surprise repairs can wreck your budget if you're not ready for them. You can also look into Major Mechanical Protection plans (MMP) plans, which help cover repair costs.

Your Two Main Buying Options

Buying New

A brand-new car means you get the latest safety features, a full warranty, and nobody else has driven it before you. You'll pay more for these perks—higher monthly payments and more expensive insurance. New cars also lose a lot of value fast. They can drop 20% to 30% in the first year alone, starting with a 10% drop as soon as you drive it off the dealership lot.

The upside? You don't have to worry as much. You know nobody messed it up before you got it, and if something breaks, the warranty may cover it. Plus, you can pick the color and features you want. If you're buying new, save up for a down payment—at least 10% to 20% of the price. This helps with lower your monthly car loan payment.

Buying Used

Used cars are an affordable car option if you shop smart. A three-year-old car with 36,000 miles has already lost more than half of its value, but may still have a lot of life left. You'll pay less, which means lower monthly payments and lower insurance costs. If this option is best for you, there are additional choices: buy from a used auto dealership or buy from a private seller (someone off the street or a public online listing).

Buying a used car from a dealer is the safer and more controlled option compared to buying from a private seller. They also have multiple cars to choose from and finance options. Additionally, dealers usually offer warranty options or some type of safeguard with their car sales.

However, this option is usually more expensive than buying from a private seller. Negotiating is harder with dealers since pricing is more structured. It’s a good idea to research the car you're interested in before going into the dealership so you’ll have more confidence when negotiating.

Buying a used car from a private seller is typically a more cost-effective option. You have more negotiating power because the seller usually invests personal time and effort in marketing their car.

The downside is that there are risks involved. You're buying someone else's car, so you don't know everything that has happened to it. You don’t know if it’s ever been labeled a total loss by an insurance company or has a financial lien on it. Unlike dealers, you won’t have a warranty on it either.

Since there are risks associated with buying from both used car dealers and private sellers, you need some ways to help protect yourself before you buy. When you think you found the vehicle you want, purchase a vehicle history report from a reputable service such as Carfax, AutoCheck or the official National Motor Vehicle Title Information System (NMVTIS) website. In addition, have a mechanic you trust check the vehicle out before you buy.

Shopping for a used car takes patience. It’s best to compare different cars, read reviews about which ones last longer, and sometimes walk away from deals that seem sketchy. But when you find one that fits your needs, you'll have payments you can handle and money left over for maintenance and repairs.

Smart Moves Before You Buy

Try Out Your Budget First

Figure out what your total cost for your monthly car payment and other car costs will be. Then, start putting that amount in savings for two or three months before you actually buy the car. If you will need $500 a month to buy the vehicle you want, start saving $500 a month right now.

This will help you determine if you can really afford the vehicle. If saving $500 feels impossible or stresses you out, consider other options. If it's easy, you know owning this vehicle will work for you.

Plus, you'll be saving money for your car’s down payment while you test this out. Some people realize they'd rather buy a less expensive car and keep the extra money for other things they want. It’s best to figure that out before you've already bought the car.

Get Pre-Approved at a Credit Union

Credit union auto loans usually offer better interest rates than regular banks or dealership financing, which means lower monthly payments and less money spent on your vehicle overall. Even a 1% difference in your interest rate can save you a significant amount of money over the term of the loan.

Getting pre-approved for a credit union auto loan before you shop is super helpful. You'll know exactly how much you can spend, and you're basically a cash buyer when you walk into the dealership. This helps you avoid falling in love with a car that doesn't have loan terms that fit your budget.

Having a pre-approved loan takes the guesswork out of how much car you can afford. You'll know your budget, your interest rate, and roughly what your monthly payment will be before you even step on the lot. Check out the available rates and apply online to see what you qualify for.

If you are still building your credit and need a car loan, look for programs for first-time buyers. These may qualify you for a car purchase as well as help you establish credit.

If you have a short credit history or a low credit score, you may still qualify for a credit union auto loan by applying with a co-applicant. This person would be legally responsible for the loan if you can't make the payments.

Making Your Choice

Figuring out what you can afford isn't about buying the most expensive car your income allows. It's about choosing a vehicle that fits your life without causing financial stress. You probably have other things you want to do besides just making your monthly car payments—hanging out with friends, saving for the future, maybe taking a road trip.

Pre-Car Shopping Checklist

checkbox Use the 15% to 20% rule to calculate your budget.

checkbox Consider the total cost, including a monthly car payment and extra costs like insurance, maintenance, repairs, and gas.

checkbox Test your numbers by actually saving that amount each month before you buy anything.

checkbox Look at both new and used cars to determine what makes sense for you, not just what seems cooler.

If you need help budgeting, make an appointment with one of our Financial Coaches. They’ll work with you to create a personalized plan to help you get into your next car.

Veronica Balderas Financial Coach |

About the Author For the past five years, Veronica has provided members with the tools to create personalized financial plans that align with their goals. She offers information regarding budgeting, savings strategies, and spending plans to help members stay on track for long-term financial stability. Whether you're working to pay off debt, improve your credit score, or navigate a major financial change, Veronica provides practical advice. She focuses on building financial literacy and attacking complex challenges. Her hands-on approach ensures members are able to gain a better understanding of their finances and a clear plan for the future. |

|